Although it’s been a good year for gold, it’s been even better for Palladium. So, what is Palladium and what is causing the high price?

by Les Kendall

At the time of writing, Gold has pushed past $1,600/oz but Palladium has gone past $2,600. Platinum is still below $1,000. What’s driving Palladium’s price?

Physically, What is Palladium?

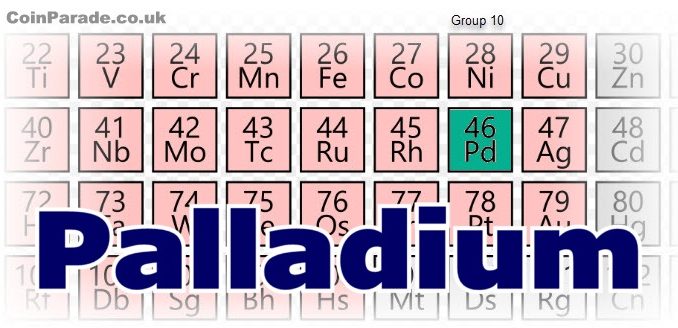

Palladium is a silvery-white metal. It has a chemical symbol ‘Pd’ and atomic number 46. It was discovered in 1803 by English chemist William Hyde Wollaston, who named it after an asteroid called Pallas which passed Earth the previous year. On the Periodic table it is in the same group as Platinum and on the left of Gold.

What is the Main Cause of the High Price of Palladium?

It’s all about supply and demand. The main reason Palladium is so expensive is that since 2012 demand has exceeded supply every year.

Who Uses Palladium?

The majority of Palladium use is in the automobile industry. Car engines throw out some very toxic gases and they have to be passed through a device called a Catalytic Converter. All petrol and diesel cars have catalytic converters and what makes them work are elements like Palladium and Platinum.

Catalytic converters convert about 90% of gases like carbon monoxide, nitrogen dioxide and other hydrocarbons into safer gases like carbon dioxide, nitrogen and water vapour. Diesel cars used Platinum but petrol cars use Palladium. As governments force lower emission standards and outlaw diesels, more Palladium is required.

Palladium is also used in electronics, medical equipment, jewellery (as a white-gold alloy), dentistry and a few other industries.

As the price has risen, Palladium has also become a vehicle for investment, which also leads to hoarding and stockpiling. Palladium coins have been around from the 1960’s but, together with bars, are becoming more sought after. Palladium even has it’s own currency ISO currency code of XPD.

Where do we get Palladium from?

In 2017 the major producers were South Africa (86.5 tonnes), Russia (85.2 tonnes) and Canada (17.0 tonnes). Comparing to other precious metals, top producer South Africa produced 143 tonnes of Platinum and China produced 420 tonnes of gold in 2017.

Palladium Ore deposits are very rare and a lot of the metal is obtained by recycling, especially recycling of catalytic converters.

Fuel Cells

The Electric Vehicle market also has an interest. Fuel cells and Hydrogen Cars are the future. Clean, low cost energy. Palladium (and also platinum and gold) may be key components of fuel cells.

Fuel Cells which are similar to batteries but not the same. A fuel cell converts abundant gases like hydrogen and oxygen into water, and in the process it produces electricity. It’s a win-win situation – low cost energy with little pollution.

Fuel cells can last for 200,000 miles (probably the lifetime of the vehicle itself) and then be recycled. There are already commercial vehicles on sale, like the Toyota Mirai.

It’s not wishful fantasy; Fuel Cells are already a billion dollar industry. The scarcity of Palladium and this oncoming demand may push precious metal prices astronomically.